News and Insights

We believe in sharing knowledge for the benefit of our clients to help you stay informed about the matters that affect you, your family and your business.

Our easy to understand, jargon free news and insights will enable you to stay up to date with a range of topics from legislative changes to news and case studies as well as practical guidance and advice that will help you to navigate your opportunities and challenges.

How to prepare for a secure business exit

Blog

–

Harrison Drury appoints new head of business development to drive growth

News

–

Leisure Sector Update: Where is the Employment Rights Bill up to?

Newsletters

–

Leisure Sector Update: Employment Rights Bill – Implementation Road Map

Newsletters

–

Harrison Drury invests for its people with Clitheroe office move

News

–

Statutory demands – cost effective debt recovery for contractors?

Blog

–

Kelly becomes latest recruit for Harrison Drury’s residential property team

News

–

Navigating warranty claims after buying or selling a business

Blog

–

Leisure Sector Update: Court Ruling on Insurance Rent Charges

Newsletters

–

Understanding Family Investment Companies for wealth planning

Blog

–

Human rights and the Landlord and Tenant Act 1954

Blog

–

Understanding expert impartiality in legal cases

Blog

–

Harrison Drury supports council in removing trespassers from two city parks

Blog

News

–

Harrison Drury boosts insolvency law team with new appointments

News

–

What Kwik-Fit Properties Ltd v Resham Ltd means for commercial lease renewals

Blog

–

Leisure Sector Update: Practical implications of the UK Supreme Court ruling on the definition of ‘woman’ and ‘sex’

Newsletters

–

Understanding health and safety prosecutions without accidents

Blog

–

Harrison Drury continues to expand Manchester corporate team with latest appointment

News

–

Harrison Drury helps secure future of global tech recruitment firm

News

–

Harrison Drury makes 17 promotions in latest commitment to staff development

News

–

Harrison Drury advises long-standing Preston based firm on leadership transition

News

–

Harrison Drury advises on acquisition of iconic Belsfield Hotel

News

–

Harrison Drury strengthens wills, trusts and probate offering in Manchester with key hire

News

–

Leisure Sector Update: VE Day Celebration and Licensing hours extension from 11pm – 1am

Newsletters

–

A High Court decision against granting interim injunctions in relation to rights of light

News

–

Harrison Drury bolsters commercial property team in Manchester

News

–

Commercial and IP solicitor joins Harrison Drury’s Manchester team

News

–

Leisure Sector Update: May Bank Holidays and Temporary Event Notices

Newsletters

–

Experienced probate specialist joins Harrison Drury’s wills, trusts and probate team

News

–

Leisure Sector Update: Easter and Temporary Event Notices

Newsletters

–

Harrison Drury strengthens land and property dispute resolution team with latest appointment

News

–

New regional heads appointed for Harrison Drury’s private client team

News

–

Leisure Sector Update: Bank Holidays: 1 April 2024 – 31 March 2025

Newsletters

–

Harrison Drury advises shareholders of South East-based nursery group on sale to Kids Planet

News

–

Adjudication in construction: Resolving disputes efficiently

Blog

–

Leisure Sector Update: British Summertime: A reminder

Newsletters

–

Collateral warranties in construction: Do you need one from a sub-sub-contractor?

Blog

–

Harrison Drury advises Santé Group on acquisition of popular employee wellbeing app

News

–

Unwrapping the Extended Producer Responsibility for packaging suppliers and importers

Blog

–

Leisure Sector Update: Extended Producer Responsibility (EPR)

Newsletters

–

Harrison Drury marks Manchester growth with move to larger office

News

–

Brown v Ridley: the Supreme Court clarifies the ‘ten year’ rule of adverse possession

News

–

Accelerate Action – Celebrating International Women’s Day 2025

News

–

Harrison Drury strengthens corporate team in Manchester with senior associate appointment

News

–

Misrepresentation and Section 25 notices

Blog

–

Updates to Companies House rules on identity verification and authorised corporate service providers

Blog

–

Harrison Drury partners complete management buyout

News

–

Understanding new home warranties: What homeowners need to know before making a claim

Blog

–

Harrison Drury adds to growing commercial property team

News

–

Leisure Sector Update: Off sales easements

Newsletters

–

Harrison Drury welcomes new partner to commercial dispute resolution team in Kendal

News

–

The Court of apple rules on Thatchers v Aldi

Blog

–

Leisure Sector Update: Changes to Age Verification for Alcohol Sales: The Introduction of Digital ID

Newsletters

–

Recent HSE statistics on non-fatal injuries to workers

Blog

–

Harrison Drury advises Palletower on buyout of Yorkshire racking business

News

–

Harrison Drury announces charity partners for 2025

News

–

Lucy Benton to head up Harrison Drury’s Kendal office

News

–

When to consider the removal of an executor

Blog

–

Harrison Drury appoints Heather Morris to grow insolvency team in Manchester

News

–

Reporting obligations under RIDDOR

Blog

–

Experienced associate solicitor joins Harrison Drury’s private client team

News

–

All change to business tenancies?

News

–

Experienced solicitor Kerry strengthens Harrison Drury’s commercial property team

News

–

Harrison Drury advises on major metals deal

News

–

Leisure Sector Update: Reclaiming the High Street: Government Launches Retail Auction Scheme

Newsletters

–

Experienced commercial and intellectual property lawyer joins Harrison Drury as partner

News

–

Harrison Drury helps Preston bar launch Christmas Market attraction

News

–

A review of the recent changes bringing in high street rental auctions

Blog

–

Harrison Drury teams advise on major care sector transaction

News

–

Damage to commercial buildings from adverse weather – who’s responsible for repairs?

Blog

–

Harrison Drury completes merger with Merseyside specialist family law practice

News

–

Leisure Sector Update: The Christmas period and Temporary Event Notices

Newsletters

–

Harrison Drury grows employment team in Manchester

News

–

Autumn Budget 2024 in review – What farmers and landowners should be considering now

Blog

–

Autumn Budget 2024 in review – What will be the impact on M&A activity?

Blog

–

Harrison Drury becomes a strategic partner of Preston Partnership

News

–

Harrison Drury retains place in Best Companies to Work For list

Awards

News

–

Farm Safety: Fatal injury statistics and HSE inspections and prosecutions

Blog

–

Leisure Sector Update: The Hidden Challenges of Regaining Possession of Closed Pubs

Newsletters

–

Imminent new legal duty on employers to prevent sexual harassment

Blog

–

Harrison Drury gains Chambers and Partners rankings

Awards

News

–

Leisure Sector Update: A timely reminder in relation to some upcoming dates for the diary

Newsletters

–

Alex, Ben and Charles qualify as solicitors

Careers

News

–

Harrison Drury has more teams recognised by prestigious Legal 500

Awards

News

–

Harrison Drury unveils new partner and associate solicitors in latest round of promotions

Careers

News

–

Leisure Sector Update: Imminent new legal duty on employers to prevent sexual harassment

Newsletters

–

Rahman v Hassan: Defining the donatio mortis causa

Blog

–

Covid-19 support scheme abuse: The Insolvency Service and the appointment of a Covid corruption tsar

Blog

–

Victoria adds experience to Harrison Drury’s contentious probate and trusts team

News

–

Criminal offences relating to the new corporate compliance regime under the Economic Crime and Corporate Transparency Act 2023

Blog

–

Harrison Drury grows residential conveyancing team in Lancaster

News

–

Harrison Drury looks to future with 2024 trainee and apprentice intake

News

–

Harrison Drury advises on seven-figure haulage sector deal

News

–

What is a specified default termination provision in construction law?

Blog

–

Dynamic pricing – Are concert goers right to look back in anger?

Blog

–

Harrison Drury advises Panoramic on growth investment in Millercare

News

–

Leisure Sector Update: Pret a Manger’s Body Camera Trials – Employment and Data Protection Considerations

Newsletters

–

Harrison Drury grows property litigation team in the North West

News

–

Harrison Drury advises on acquisition of Lake District hotel

News

–

Tree restocking notices – what landowners and developers needs to know

Blog

–

Historic Lancashire trout farming firm expands to fourth site, with support from Harrison Drury

News

–

Leisure Sector Update: A-Level Results Day: Reminder on Alcohol Sales and Underage Compliance

Newsletters

–

Supreme Court ruling on collateral warranties and construction contracts

Blog

–

Harrison Drury announces new appointment for construction law team in Manchester

News

–

Supporting non-gender conforming children as a separated parent

Blog

–

Leisure Sector Update: Summer Bank Holiday – what you need to know

Newsletters

–

Understanding the role of the accountant when a company is insolvent

Blog

–

Harrison Drury secures possession orders for two clients impacted by trespassers

News

–

Dealing with child arrangements during the school holidays

Blog

–

Leisure Sector Update: Employment law changes announced in the King’s Speech

Newsletters

–

Déjà vu as the Renters’ Reform Bill comes round again in King’s Speech

Blog

–

Employment law changes in the King’s Speech – How they will affect your business

Blog

–

Key changes in the JCT 2024 Suite of Contracts

Blog

–

Harrison Drury appoints barrister Paul Brook to enhance client offering

News

–

James and Simon launch ‘green commute’ charity challenge in memory of much-loved colleague

Blog

–

What employers need to know about The Employment (Allocation of Tips) Act

Blog

–

Leisure Sector Update: The Employment (Allocation of Tips) Act: What Employers need to know

Newsletters

–

Clarifying the slip rule in construction disputes

Blog

–

Harrison Drury strengthens residential conveyancing team

News

–

Who stores a copy of my will and where is it stored?

Blog

–

Euro 2024 – Safely managing your licensed premises

Blog

–

New partner bolsters Harrison Drury’s corporate offering in Manchester

News

–

Senior appointment boosts Harrison Drury’s commercial property team

News

–

How to recognise financial abuse in a relationship

Blog

–

Leisure Sector Update: Update to Hours for Euro 2024

Newsletters

–

New partners David and Jamie join our employment team

News

–

Euro 2024 – A guide to the key employment law issues

Blog

–

Leisure Sector Update: Hours for Euro 2024

Newsletters

–

Can security for costs delay adjudication enforcement?

Blog

–

Do I have to share my inheritance after a divorce?

Blog

–

Leisure Sector Update: Levelling Up and Regeneration Act 2023.

Newsletters

–

On Tower UK Ltd v BT – Understanding the termination of a code agreement

Blog

–

Leisure Sector Update: May Bank Holidays and TEN notices

Newsletters

–

Senior appointment strengthens Harrison Drury’s corporate team in Manchester

News

–

Harrison Drury makes six promotions

News

–

Leisure Sector Update: Holiday accrual and pay for irregular and part year workers – what you need to know.

Newsletters

–

Harrison Drury expands residential property team with latest appointment

News

–

Clare, Holly and Victoria appointed branch leaders of Harrison Drury offices

News

–

Leisure Sector Update: Changes to the National Minimum Wage (NMW) – what you need to know

Newsletters

–

April 2024 Employment Law changes – what businesses need to know

Blog

–

What landlords and tenants need to consider when opposing lease renewals

Blog

–

The benefits of nesting when co-parenting a child

Blog

–

Inspiring inclusion for International Women’s Day 2024

Blog

–

New recruits strengthen Harrison Drury’s employment and corporate teams in Manchester

News

–

Leisure Sector Update: Timely reminders for upcoming dates that may require a Temporary Event Notice (TEN)

Newsletters

–

New heads for Harrison Drury’s commercial property team

News

–

Leisure Sector Update: Government consultation on terrorist attacks

Newsletters

–

Harrison Drury helps Manchester pharmacy reopen after shock closure

Blog

–

Evicting unknown trespassers – What the latest Supreme Court ruling means for landlords

Blog

–

New controls on holiday lets – what’s changed?

Blog

–

Pre-nuptial agreements: Do you need one?

Blog

–

What are property searches and why should they be carried out?

Blog

–

What should happen to an employee’s shares when they exit a business?

Blog

–

Former regional banking head joins Harrison Drury

News

–

Harrison Drury announces 2024 line up of charity partners

News

–

National Apprenticeship Week Q&A: Kristian Torgersen

Blog

–

National Apprenticeship Week Q&A: Georgina Mackereth

Blog

–

Leisure Sector Update: Incorporating digital identities and technology in age verfication processes

Newsletters

–

National Apprenticeship Week Q&A: Tom Connell

Blog

–

National Apprenticeship Week Q&A: Taylor Eastham

Blog

–

Pharmacy First Service – Guidance for your pharmacy business

Blog

–

Harrison Drury advises Kendal College on acquisition of Westmorland Shopping Centre

News

–

The effectiveness of disclaimers and accountants’ duties to third parties

Blog

–

Two senior appointments for Harrison Drury’s Manchester office

News

–

Leisure Sector Update: Valentines Day Licences

Newsletters

–

Economic Crime and Corporate Transparency Act – Changes to Companies House in March 2024

Blog

–

Latest appointments strengthen Harrison Drury’s property litigation team

News

–

What the Post Office IT scandal can teach us about conducting workplace investigations

Blog

–

Leisure Sector Update: Enforcement against licensed premises

Newsletters

–

Harrison Drury opens Manchester office and makes senior hire as part of growth strategy

News

–

Harrison Drury recruits former corporate banker to support growth strategy

News

–

Can I find out about a partner’s potential history of domestic abuse? A guide to Clare’s Law

Blog

–

Jake joins Harrison Drury’s commercial property team

News

–

Harrison Drury recruits employment law specialist to join growing team

News

–

Harrison Drury supports RSPCA to open new Lancashire shop

News

–

The dangers of using unregulated will writers

Blog

–

Making arrangements for children at Christmas

Blog

–

New hospitality venue brings a unique experience to Longton

News

–

To break or not to break – when will the Court grant a landlord break clause in a renewal lease?

Blog

–

Taking the apprentice route – A Career Conversation with Rachael McDonagh

Blog

–

You have been appointed an Executor. What happens now?

Blog

–

Mark Traynor appointed to lead Harrison Drury’s NW corporate team

News

–

Harrison Drury makes five promotions

News

–

Record number of Harrison Drury lawyers recognised in prestigious Legal 500

News

–

“Do something you love” – A Career Conversation with Hannah Pinder and Chloe Wishart

Blog

–

Five adjustments employers can easily make to assist employees experiencing menopause

Blog

–

Rachael becomes our first apprentice to qualify

News

–

Employee side hustles – What you need to know as an employer

Blog

–

Fixed Recoverable Costs and the New Intermediate Track

Blog

–

Harrison Drury makes Top 100 ‘Best Companies’ list

News

–

Family disputes – what are your rights when operating a family business?

Blog

–

From trainee to partner – A Career Conversation with Jack Stephenson

Blog

–

Experienced solicitor joins Harrison Drury’s growing private client team

News

–

Harrison Drury recruits six trainees and apprentices

News

–

Demand for specialist estate planning advice supports growth of private client team

News

–

How we made it possible: Helping a client retrieve valuable confidential data taken by an employee

Blog

–

New tenants secured for commercial properties near Preston

News

–

Factory automation specialist targets growth with move to new premises

News

–

Leisure sector team helps Ed and Laura secure lease for 18th century Ribble Valley pub

News

–

Experienced solicitor joins Harrison Drury’s commercial property team

News

–

Six life events that should prompt you to update your Will

Blog

–

Dispute resolution expert strengthens Harrison Drury’s litigation team

News

–

Overcoming school holiday conflict as a separated family

Blog

–

Corporate team supports growth for acquisitive legal firm

News

–

Series or instalments: What payment option is best suited for your financial settlement

Blog

–

Navigating contact with your children on Father’s Day

Blog

–

How employers can help their staff with loneliness at work?

Blog

–

What is a grant of probate and when is it required?

Blog

–

Estate planning specialist Donna joins Harrison Drury’s Lytham team

News

–

Harrison Drury doubles size of Kendal office to support client growth plans

News

–

Harrison Drury supports logistics firm’s £12m HQ purchase

News

–

What happens during an Insolvency Service investigation and how it may affect the company’s directors

Blog

–

The importance of supporting your employees’ mental wellbeing

Blog

–

Renowned construction lawyer Katherine joins Harrison Drury as partner

News

–

Harrison Drury grows Lytham team with Emma and James appointments

News

–

Employee tips and service charges – Everything you need to know about the new law on allocating tips

Blog

–

Government seeks feedback on plans for a new ‘use class’ for short-term lets

Blog

–

Hospitality sector update: Preparing for the King’s coronation

Blog

–

What information is a trader obliged to share with its customers?

Blog

–

Carlo’s new venue offers Clitheroe a touch of Italy

News

–

How to use employment policies to become more sustainable and improve staff retention

Blog

–

Renewed calls for legal framework to protect cohabiting couples

Blog

–

Sale of St Annes buildings supports town’s regeneration masterplan

News

–

Terms and conditions: Why they are so vital for your new business

Blog

–

EPC rating update: Landlords must comply with new requirements

Blog

–

Jack becomes partner as Harrison Drury makes 10 promotions

News

–

Employment tribunal statistics update and why good employee relations is important

Blog

–

Updated government how to rent guidance: What landlords need to know

Blog

–

Preston-based entrepreneur expands serviced office business with Leyland purchase

News

–

How business valuations are dealt with during divorce proceedings

Blog

–

Supporting Muslim employees during Ramadan

Blog

–

The importance of agreeing terms and conditions in the delivery of goods

Blog

–

Rural property lawyer Jane joins Harrison Drury

News

–

International Women’s Day 2023 – Perspectives from four women in law

Blog

–

Harrison Drury advises BREC founder on sale of conveyor belt specialist

News

–

A new approach to employee relations

Blog

–

Harrison Drury announces its charity partners for 2023

News

–

Harrison Drury supports buyout at Preston-based luxury fireplace retailer

News

–

New fire safety regulations – your responsibilities as a landlord or building manager

Blog

–

Katy strengthens Harrison Drury’s employment law team

News

–

Fish farm targets Yorkshire expansion after securing 15-year lease with Environment Agency

News

–

How to support employees’ financial wellbeing during the cost-of-living crisis

Blog

–

Rural specialist Wayne joins Harrison Drury

News

–

Why do I need a will?

Blog

–

Why I chose to take the apprenticeship route – an interview with Tom Connell

Blog

–

Wills and inheritance specialist Rebecca joins Harrison Drury’s Lancaster team

News

–

Administration and liquidation: The different outcomes for employees of two collapsed sports clubs

Blog

–

The importance of a legally binding order to record your financial settlement on divorce

Blog

–

Employment law update: What to look for in 2023

Blog

–

Harrison Drury welcomes back commercial property specialist Rhian Sale

News

–

What we learned as trainee solicitors – An interview with Zoe and Peter

Blog

–

Harrison Drury’s High Court victory highlights issue of compliant witness statements

Blog

–

New FD Alexander will support growth at Harrison Drury

News

–

Preparing a notice to quit an agricultural holding tenancy: The importance in checking recipient details are correct

Blog

–

Building Safety Act 2022: A summary of key provisions

Blog

–

Work Christmas parties: Celebrating the festive season safely

Blog

–

Harrison Drury opens Lytham office

News

–

Common questions about divorce: How can I protect my interest in the matrimonial home?

Blog

–

What alternatives are there to court in divorce?

Blog

–

Harrison Drury grows residential property team with two new hires

News

–

Can employers monitor employees? Proposed new guidance from ICO

Blog

–

New food labelling requirements delayed: An update for food businesses in the UK

Blog

–

Harrison Drury joins forces with local business partners to clean up the Morecambe coastline

News

–

Covid-19 Bounce Back Loan scheme: the implications of fraud by misrepresentation and related offences

Blog

–

Selling a business through a management buyout

Blog

–

Harrison Drury welcomes three new trainee solicitors

News

–

What should I expect in a remote Family Court hearing?

Blog

–

Harrison Drury gains further recognition in prestigious Legal 500

News

–

What is the holiday entitlement and pay for part-year workers?

Blog

–

Harrison Drury advises on buyout of luxury portable loo firm

News

–

Will we see an upswing in health and safety enforcement after the pandemic?

Blog

–

Use of private email and messaging apps: the data protection implications for business.

Blog

–

What happens in child arrangements proceedings?

Blog

–

Harrison Drury renews support for Preston Grasshoppers with sponsorship deal

News

–

Ending an Assured Shorthold Tenancy – the rules on Gas Safety Certificates

Blog

–

Common questions on divorce: Will I lose my legal rights regarding the family home if I move out?

Blog

–

An outline of the Leasehold Reform (Ground Rent) Act 2022

Blog

–

Terry bolsters Harrison Drury’s regulatory team

News

–

I’m divorced, can I take my children on holiday abroad?

Blog

–

Landmark judgment on collateral warranties used in new Court of Appeal case

Blog

–

Commercial rent arrears – Do I have to pay rent if I closed during the pandemic?

Blog

–

Clare joins commercial property team at Harrison Drury

News

–

UK data protection regime reform: Data Protection and Digital Information Bill introduced to Parliament

Blog

–

Can Long Covid be considered a disability?

Blog

–

Harrison Drury adds sector specialist to commercial property team

News

–

New EPC ratings: How green is your lease?

Blog

–

What are the options for dealing with pensions in a divorce?

Blog

–

Managing personal data collected and used during the pandemic: Stay compliant

Blog

–

Staff health checks become latest employee wellbeing initiative for Harrison Drury

News

–

The four-day working week: How it may affect the leisure and hospitality sectors

Blog

–

Jessica joins Harrison Drury’s commercial litigation team

News

–

Harrison Drury advises on major caravan park deal

News

–

Harrison Drury strikes partnership deal with Swinton Lions RLFC

News

–

Harrison Drury advises Walker Fire on two acquisitions

News

–

Using sustainability to attract employees – top tips for contracts and business practices

Blog

–

Harrison Drury makes five promotions

News

–

No-fault divorce law – The key changes

Blog

–

IR35 and off-payroll working rules in the private sector: One year on

Blog

–

Offering work to Ukrainian refugees – What you need to consider

Blog

–

The Commercial Rent (Coronavirus) Act

Blog

–

Harrison Drury recognised for Wills and Probate expertise in national awards

News

–

Harrison Drury announces its 2022 charity partners

News

–

Entrepreneur opens Thai restaurant with ‘street market’ feel in Lancaster

News

–

Accommodation for agricultural workers

Blog

–

Harrison Drury adds to commercial property team in Clitheroe

News

–

What is a Business Lasting Power of Attorney, and do I need one?

Blog

–

Harrison Drury helps PJM Property Investments Group acquire three new sites

News

–

Can I make arrangements with my ex-partner to spend time with my child?

Blog

–

Committed carers Cheryl and Kirk become new owners of Lytham care home

News

–

Entitlement to paid annual leave: The case of Smith v Pimlico Plumbers Limited

Blog

–

What UK businesses need to consider before making international transfers of personal data

Blog

–

COVID-19 vaccination status: How easy is it for employers to change rules regarding sick pay?

Blog

–

Can a commercial landlord terminate a tenancy for occupation for its own use?

Blog

–

Queen’s Platinum Jubilee 2022: Are my employees entitled to the extra bank holiday?

Blog

–

Agricultural specialist joins Harrison Drury

News

–

How to recover agricultural land from tenants to create woodland schemes

Blog

–

An introduction to the Environment Act 2021 and important updates for land and property developers

Blog

–

Retaining hospitality staff – A conversation with James’ Places

Blog

–

What are the latest rules on face coverings and COVID passes? – December 2021

Blog

–

What does the Supreme Court judgment in Lloyd v Google mean for your business?

Blog

–

What is probate? A quick and easy guide for executors

Blog

–

Looking after your hospitality staff in a post-pandemic era

Blog

–

GDPR and data protection reforms – A look at what’s been proposed

Blog

–

New laws and Code of Practice for commercial rent arrears – what does it mean for you?

Blog

–

Will I receive a share of my spouse’s pension in our divorce settlement?

Blog

–

Harrison Drury builds commercial property team with new appointment

News

–

Budget 2021 – Government listening to hospitality sector but more support needed, says Malcolm

Blog

–

Harrison Drury rises in Legal 500 rankings

News

–

How to manage a permanent ‘hybrid’ working model in your business

Blog

–

Harrison Drury welcomes new trainees and apprentices

News

–

Blackpool holiday firm toasts latest expansion

News

–

Carbon management for rural business – What are the new funding opportunities?

Blog

–

Common questions on divorce: Who gets to keep the dog?

Blog

–

Do employers have a duty to consider furlough to avoid redundancy?

Blog

–

The new rules for Right to Work checks for EEA citizens after July 2021

Blog

–

Lara joins Harrison Drury’s commercial property team

News

–

Harrison Drury advises on over £100m of deals

News

–

Guidance to protect employees and customers in the hospitality sector as lockdown ends

Blog

–

Expansion plans heating up for North West restaurant chain after successful Blackburn launch

News

–

Capital Gains Tax on financial transfers in divorce: A much-needed change to the rules?

Blog

–

Children’s charity makes permanent home in Morecambe

News

–

Lasting Powers of Attorney – The importance of making the right choice

Blog

–

Three new faces at Harrison Drury

News

–

Treatment of tips and gratuities to be considered in parliament

Blog

–

What is spousal maintenance and when does it apply?

Blog

–

Harrison Drury advises on buyout of legal publishing company

News

–

Harrison Drury strengthens hospitality team with Malcolm Ireland appointment

News

–

Delay to no-fault divorce law

Blog

–

Court victory for Cumbria Safari Zoo operator allows attraction to remain open for business

News

–

The benefits of a private financial dispute resolution appointment in divorce proceedings

Blog

–

Supporting women at work during menopause

Blog

–

Five green changes for businesses to prepare for in 2021

Blog

–

Greetings card business celebrates launch of second shop in Lytham

News

–

What happens to the family farm in a divorce?

Blog

–

Fire and rehire – why employers should tread carefully

Blog

–

Harrison Drury makes trio of appointments

News

–

What to expect in divorce court: Financial remedy proceedings

Blog

–

How do I make our financial settlement legally binding?

Blog

–

Two Harrison Drury solicitors shortlisted for prestigious industry award

News

–

Recent employment case law and the implications for employers

Blog

–

How are pensions shared in a divorce?

Blog

–

Five promotions at Harrison Drury

News

–

Five key questions about divorce

Blog

–

Preparing for the first consultation about your divorce

Blog

–

Harrison Drury grows Lancaster presence with office move

News

–

Budget 2021: What employers need to know

Blog

–

Recording your employees’ vaccination status

Blog

–

Tim strengthens corporate team at Harrison Drury

News

–

Is it good commercial sense to make a business Lasting Power of Attorney?

Blog

–

Applying off-payroll working rules (IR35) for private sector companies

Blog

–

Victoria joins Harrison Drury’s private client team in Clitheroe

News

–

Rural sector update: The risks arising from the use of pesticides on farmland

Blog

–

Lancashire mobility specialist acquired by new owners

News

–

Popular village pub in Barley saved from closure by locals

News

–

How to support an employee with cancer

Blog

–

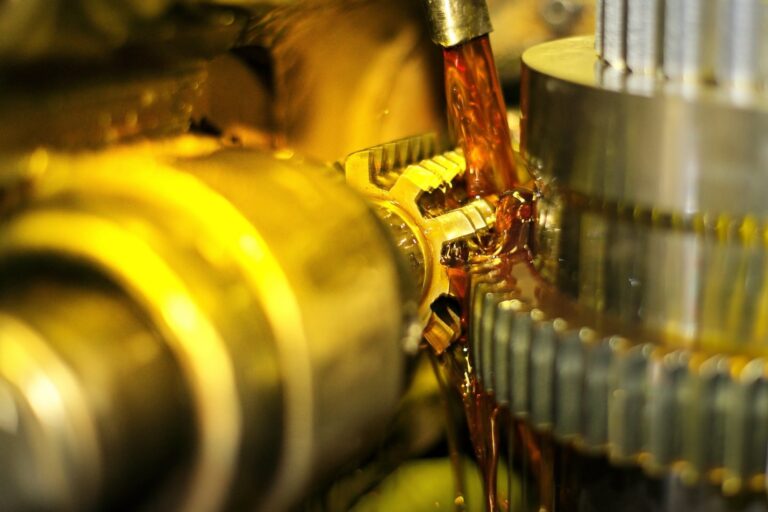

Harrison Drury advises Broughton Lubricants on sale to leading UK firm

News

–

Farmers and growers: The benefits and pitfalls of supply contracts

Blog

–

James wins rights to an audience with the high court

News

–

Furloughing working parents during school closure

Blog

–

Harrison Drury advises Walker Fire on latest acquisition

News

–

Businesses urged to review algorithm processes that may lead to bias or discrimination

Blog

–

Harrison Drury looks to the future with launch of HD Academy

News

–

Harrison Drury advises on petrol forecourts deal

News

–

Businesses urged to review international data transfers to ensure adequate safeguarding measures

Blog

–

Preparing your business for sale during COVID-19

Blog

–

Heads of Terms for property transactions – How to get it right

Blog

–

Should I gift my home to my children to mitigate Inheritance Tax?

Blog

–

The implications for waste disposal companies that do not comply to regulatory responsibilities

Blog

–

E-marketing to customers during lockdown – A recap on data and privacy rules

Blog

–

Furlough extension – Everything you need to know

Blog

–

The importance of monitoring client data transfers between EU and the US

Blog

–

Harrison Drury looks to the future with new trio

News

–

Job Support Scheme payments – Reducing the risk of fraudulent claims

Blog

–

The Job Support Scheme: The government’s new scheme to further help retain employees

Blog

–

ICO penalty against British Airways a stark reminder to protect client data

Blog

–

COVID-19 update: Commercial landlords and tenants

Blog

–

What is an employee’s right to privacy while working from home?

Blog

–

Blackpool pet bakery celebrates steady rise in business after relocation

News

–

Harrison Drury strengthens presence in Legal 500

News

–

Ensuring employees self-isolate – your responsibilities as an employer

Blog

–

Latest coronavirus rules for hospitality sector – protecting your premises licence

Blog

–

Structuring a business sale following coronavirus

Blog

–

Jenna’s acts of kindness boost charities and colleagues

News

–

HMRC given further regulatory powers to investigate CRJS furlough fraud

Blog

–

Nick Booth named new head of Harrison Drury’s corporate and commercial division

News

–

The impact of energy efficiency regulations on the rural commercial property sector

Blog

–

Holly joins Harrison Drury’s private client team in Lancaster

News

–

What happens if a furloughed employee has EMI options?

Blog

–

Mixed-use Stamp Duty Land Tax: When can you claim?

Blog

–

Residential landlords update: Prepare now to reactivate possession proceedings

Blog

–

Employee or self-employed? Why it is such an important decision for business owners

Blog

–

Nicola and Hannah chosen to lead Harrison Drury offices

News

–

Executors of wills breaching their duties – What can be done?

Blog

–

Are written tenancy agreements really that important for rural properties?

Blog

–

Changes to the UK insolvency regime

Blog

–

Managing your team structure as CJRS ends

Blog

–

An end to ‘blame’ in divorce set for Autumn 2021

Blog

–

Factors to consider before selling part of your farmland

Blog

–

How the new Job Retention Bonus will work

Blog

–

How will the stamp duty holiday work?

Blog

–

The chancellor’s summer statement: Getting the economy back on track

News

–

Harrison Drury helps Joseph make the cut in Whalley

News

–

Do I need a partnership agreement for my family farming business?

Blog

–

Harrison Drury supports housing developer’s latest project

News

–

Coronavirus and the regulatory burden of care home management

Blog

–

Dairy Response Fund – Support launched for dairy farmers

Blog

–

Rights and remedies for tenants and landlords following coronavirus

Blog

–

What if there’s no written lease?

Blog

–

Is it possible to own ‘wildlife’ when buying or selling agricultural land?

Blog

–

New director Clare will lead our private client team

News

–

Introducing ‘flexible furlough’ – further changes to Coronavirus Job Retention Scheme

Blog

–

Managing residential lettings on rural properties

Blog

–

How will the Coronavirus Job Retention Scheme (CJRS) operate after June 2020?

Blog

–

Taking the right path on redundancy and restructuring

Blog

–

Turnover Rent: A future consideration for commercial landlords and tenants

Blog

–

Top tips for managing seasonal workers for businesses in the agricultural sector

Blog

–

Plan early to avoid unnecessary redundancies, warns employment lawyer Roger Spence

Blog

–

Coronavirus Job Retention Scheme: Preparing your employees’ return to work

Blog

–

Construction sector update: Managing the reopening of sites

Blog

–

Making Lasting Powers of Attorney to manage your affairs during lockdown

Blog

–

What social distancing means for business: Manufacturing

Blog

–

A guide to commercial contracts and force majeure clauses

Blog

–

Rural sector update: Agricultural subsidies and preparing for an uncertain future

Blog

–

Planning for the future – Getting restructuring and redundancy right

Blog

–

Can early years providers access the Coronavirus Job Retention Scheme?

Blog

–

Preparing a will during the coronavirus lockdown

Blog

–

Coronavirus: How to preserve commercial landlord and tenant relationships

Blog

–

Coronavirus Job Retention Scheme: Making a claim

Blog

–

Why you should have a will: Who will inherit and how much?

Blog

–

Coronavirus Act 2020: Implications for landlords and tenants

Blog

–

Furloughing workers – Do I need written agreement from staff?

Blog

–

What social distancing means for business: Hospitality and retail

Blog

–

The Coronavirus Job Retention Scheme – Updated guidance for employers

Blog

–

Coronavirus Job Retention Scheme: Warnings against fraudulent claims

Blog

–

Furloughing staff – how is annual leave affected?

Blog

–

Providing independent legal advice during the coronavirus crisis

Blog

–

Harrison Drury advises Ellison Solicitors on strategic merger

News

–

What social distancing means for business: Organising events

Blog

–

Helping St Catherine’s Hospice in these difficult times

News

–

Harrison Drury launches rapid response team for coronavirus loans

Blog

–

Witnessing documents during the coronavirus pandemic

Blog

–

Seven promotions for Harrison Drury team

News

–

A practical guide to directors’ duties during the coronavirus pandemic

Blog

–

Coronavirus: Support for the self-employed

Blog

–

How can I retain my employees during the coronavirus outbreak?

Blog

–

Coronavirus and its impact on the construction sector

Blog

–

Managing childcare arrangements for separated couples during the coronavirus outbreak

Blog

–

How businesses can protect their finances during the COVID-19 pandemic

Blog

–

The Coronavirus Bill – what it means for landlords and tenants

Blog

–

Coronavirus – Do my obligations under a commercial lease still stand?

Blog

–

How can I retain my employees during the coronavirus outbreak?

Blog

–

Coronavirus, working from home and staff absence – latest updates

Blog

–

Can coronavirus be cited in force majeure claims?

Blog

–

Harrison Drury named ‘Legal Business of the Year’ at Red Rose Awards 2020

News

–

Budget 2020 and coronavirus – What employers need to know

Blog

–

Harrison Drury announces chosen charities for 2020

News

–

Attractive future for Clitheroe beautician’s business

News

–

Coronavirus in the workplace – reducing risk to your staff and business

Blog

–

Is an Islamic faith marriage protected under English law?

Blog

–

Harrison Drury is ‘onboard’ with Lancaster City FC

News

–

Football club dispute shows importance of shareholder agreements

Blog

–

Do directors’ duties remain after a company enters into a formal insolvency process?

Blog

–

Drafting construction contracts for modular projects – the importance of defining ‘sign off’

Blog

–

What does a ‘conservation covenant’ mean for landowners?

Blog

–

Preston firms prepare for ‘Battle of the Bands’

News

–

Katie qualifies as our new accountant

News

–

Sussex Royal saga has lessons for protecting the family business

Blog

–

What is the difference between a positive covenant and a fencing easement?

Blog

–

Government launches survey on sexual harassment in the workplace

Blog

–

Can I protect the access to sunlight to my solar panels?

Blog

–

What ‘promoting professionalism, reforming regulation’ means for healthcare professionals

Blog

–

Catherine joins Harrison Drury’s property team

News

–

Harrison Drury advises as Barton Grange hotel acquired

News

–

100 Years of Women in Law: Rebecca Patience

News

–

What happens if a valid will is found after the administration of an estate?

Blog

–

Haulage firm chooses Leyland for new distribution centre

News

–

Harrison Drury invests in future with new trainees and apprentices

News

–

Charity race night is a runaway success

News

–

Harrison Drury named Legal Firm of the Year

News

–

Lorna scales heights to raise funds for North West Blood Bikes

News

–

Say hello to our newest solicitor Kerry Southworth

News

–

Congratulations to our new solicitor Alex Walmsley

News

–

Clitheroe office raises £100 to support Shelter

News

–

Legal costs of divorce – who pays?

Blog

–

Harrison Drury welcomes new trainees

News

–

Harrison Drury’s resident band rocks London’s iconic 100 Club

News

–

New hairdressing salon makes the cut in Clitheroe

News

–

Local businesses purchase defibrillator for Winckley Square

News

–

Harrison Drury backs Preston Grasshoppers in shirt sponsorship deal

News

–

Double award win for leading Lancashire law firm

News

–

Lancaster law firm raises money for animal charity

News

–

Harrison Drury team conquer Yorkshire Three Peaks

News

–

What happened in the case of Owens v Owens?

Blog

–

Harrison Drury advises Blink-Photo on CIC Creative acquisition

News

–

Charity gig raises cash for Kendal Mountain Rescue

News

–

Harrison Drury advises Preston Grasshoppers on land sale

News

–

Young law leaders look ahead to bright future

News

–

Harrison Drury clinches ‘Best Companies’ hat-trick

News

–

Harrison Drury advises County Group on sale

News

–

Five promotions at Harrison Drury

News

–

Anvic Developments sells three offices to Seneca Property

News

–

What are the new changes to child maintenance laws?

Blog

–

Harrison Drury band rocks its way to London

News

–

Property expert Wendy joins firm’s Clitheroe office

News

–

Harrison Drury advises UAE firm on £6.5m Wrexham warehouse deal

News

–

Tracey strengthens firm’s residential property team

News

–

Legal expert Jan becomes Age UK South Lakeland trustee

News

–

Harrison Drury merges with Ribble Valley firm

News

–

Law firm’s growth leads to Preston expansion

News

–

Harrison Drury helps sell 350-year-old inn

News

–

Can my spouse refuse me a divorce?

Blog

–

New head of family law for Harrison Drury

News

–

Understanding Directors’ Personal Guarantees and Corporate Insolvency

Blog

–

Harrison Drury wins ‘Legal Business of the Year’ award

News

–

What can employers do about staff using mobile phones whilst driving?

Blog

–

Harrison Drury keeps place among UK’s top employers

News

–

Harrison Drury appoints new directors

News

–

Will I be able to keep my inheritance if I get divorced?

Blog

–

What happens when people die with no will or heirs?

Blog

–

Harrison Drury advises on Preston Grasshoppers artificial pitch investment

News

–

Band’s gig to raise cash for South Lakeland Carers

News

–

Will my son’s girlfriend be entitled to half of the house if they separate?

Blog

–

Harrison Drury uses the force for Lytham Festival

News

–

New head for Harrison Drury’s conveyancing team

News

–

Blackburn firm expands with new premises

News

–

Harrison Drury hits Top 40 in ‘Best Companies’ list

News

–

Go ahead for new industrial units in Clitheroe

News

–

Harrison Drury named among best UK employers

News

–

Harrison Drury advises on sixth County Group buyout

News

–

Clitheroe event takes in Tour of Britain

News

–

Contesting a will: What are my options if I’m left out of a will?

Blog

–

Philippa nurtures expansion at Lancaster nursery

News

–

Licensing lawyers help concert firm clinch date with Tom Jones

News

–

More growth for Harrison Drury’s property team

News

–

Lancaster solicitors expand with office switch

News

–

Challenging and enforcing restrictive covenants

Blog

–

The Cohabitation Rights Bill – what does it mean for unmarried couples?

Blog

–

Harrison Drury supports expansion at FDC Holdings

News

–

Hannah boosts property team at Harrison Drury

News

–

Harrison Drury opens Ribble Valley office following merger

News

–

Harrison Drury scoops top business award

News

–

Harrison Drury moves to grow Kendal presence

News

–

Harrison Drury invests in the future with trainees

News

–

Amanda Marwood joins Harrison Drury property team

News

–

Care comes naturally to new owner Melissa

News

–

Cumbria duo targeting restaurant success

News

–

Harrison Drury’s role in Lytham Proms success

News

–

Law firm’s role in Rod Stewart tour success

News

–

Leading lawyer Jan Wright joins Harrison Drury

News

–

Harrison Drury clinches top business award

News

–

Harrison Drury lands litigation duo

News

–

Can my former spouse force the sale of our marital home?

Blog

–

Harrison Drury helps Cuffe & Taylor expand into new premises

News

–

Harrison Drury opens Lancaster office

News

–

Harrison Drury is sailing with Rod Stewart tour

News

–

Harrison Drury takes on England

News

–

James Robbins gains insolvency qualification

News

–

Clients benefit from Harrison Drury’s international alliance

News

–

Harrison Drury helps Blackpool BID defend levy claim

News

–

High Court victory for client in property dispute

News

–

Harrison Drury opens Kendal office

News

–

Harrison Drury clinches trio of accreditations

News

–

Harrison Drury strengthens dispute resolution team

News

–

Naomi Fell joins Harrison Drury’s commercial team

News

–

Applying for relief from forfeiture

Blog

–

What is a company reorganisation and what are the legal implications?

News

–

Harrison Drury advises on purchase of iconic Old Fives

News

–

Harrison Drury completes Preston office move

News

–

Could ‘deferred consideration’ help you get that deal done?

News

–

Harrison Drury backs bid to revive historic Winckley Square

News

–

What is an injunction and who can use them?

Blog

–

The five golden rules of management buyouts

Blog

–

Harrison Drury shortlisted for Red Rose Awards

News

–

£80,000 Property Dispute dismissed after Harrison Drury legal challenge

News

–

Harrison Drury boosts litigation team

News

–

Harrison Drury opens Garstang office

News

–

HD wins top award

News

–

Chancel Repair Liability?

Blog

–

Squatters Rights?

Blog

–

Get off my land!!

Blog

–

5 things a tenant should know about commercial leases

News

–

New managing partner appointed

News

–